Your personal Medicare concierge

From learning the basics to enrolling in a plan right for you – CoverRight® is your digital Medicare concierge.

Your one-stop-shop for navigating medicare

View plans

Speak with a licensed agent

Learn about Medicare

Take a quiz

How CoverRight works

Step 1

Provide us with some basic information

This takes as little as 2 minutes. We’ll need to know what you’re looking for to help find you a plan right for you.

Step 2

Learn about Medicare

Browse our site and access online resources to easily learn about Medicare and your options.

Step 3

Book a free call with a licensed agent

Get concierge-style service with instant access to a licensed insurance agent to help with all your questions. Your agent stays with you from beginning to end.

Our platform provides the tools to help you find a plan that’s right for you

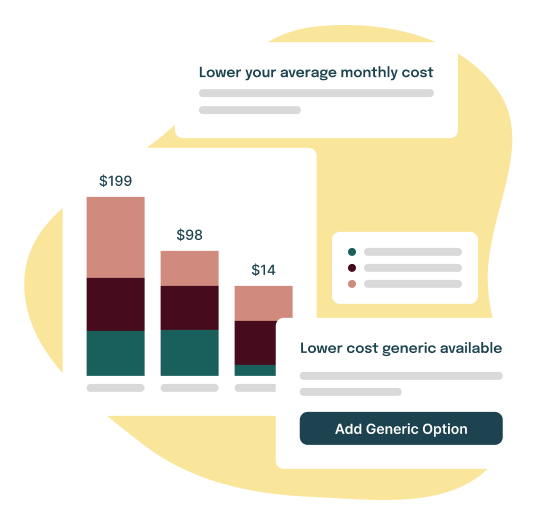

Minimize your drug costs

Don't make the mistake of assuming drug costs are similar across all plans. Enter your drugs and our platform will help surface your costs so you can compare and save.

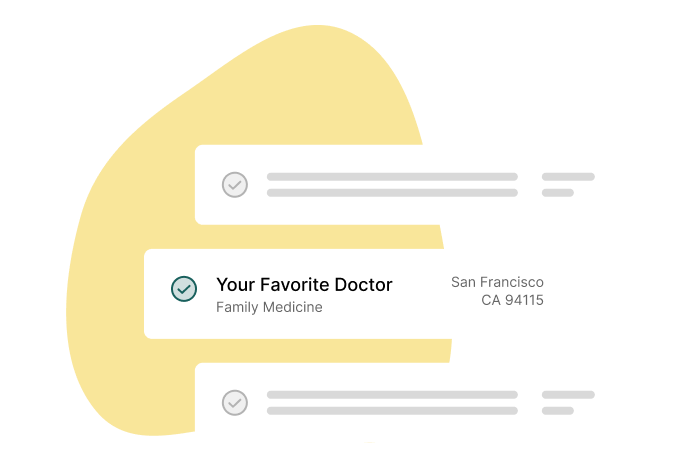

Keep your favorite doctors

Tell us your doctors you would like to keep and we will aim to help find plans that cover them in-network.

Maximize your savings and save time

Our goal is to find you Medicare coverage suited to you at an affordable price. At CoverRight®, we’ve saved customers up to $1,034 a year1 in annual costs by helping them shop the market. Our concierge-style service aims to take away the complexity so that you can save hours of research.2

Based on a CoverRight Medicare Supplement customer located in Pennsylvania

Based on testimonials from CoverRight customers on TrustPilot

Money & Time Saved

$1,034

Annual Savings1

Best Rate Guarantee

If we can’t find you the best Medicare Supplement insurance rate, we’ll give you $200 (Terms Apply). Learn more

Understanding your options all in one place

Whether it’s Original Medicare or a private Medicare plan, we will recommend the best combination of coverage that matches your needs.

Understanding the parts of Medicare

Original Medicare

Part A

Hospital Insurance

Part B

Medical Insurance

Part C

Medicare

Advantage Plans

Part D

Prescription

Drug Plans

Medigap

Medicare

Supplement

Plan Options:

Basic

Original Medicare

+ Prescription Drug Plan

No networks

Any doctor that accepts Medicare

No limit on out-of-pocket costs

You are responsible for all copays and coinsurances unless you have federal/state assistance

No additional benefits

Need to purchase dental, vision and other benefits separately

Comprehensive

Original Medicare

+ Prescription Drug Plan3

+ Medicare Supplement4

No networks

Any doctor that accepts Medicare

Limited out-of-pocket costs4

Your supplement plan helps pay for most of your out-of-pocket costs

Higher Premiums6

$90 - $300+ per month for Medicare Supplement

No additional benefits

Need to purchase dental, vision and other benefits separately

Most Popular

Medicare Advantage

or ‘Part C’

Doctor networks

Need to use in-network providers to achieve lowest cost share7

Pay-as-you-go

Pay copays/coinsurances until maximum out-of-pocket

Lower Premiums

66% of plans have $0 premium8

Additional benefits

Drug coverage, dental, vision and hearing typically included9

1. These plan combinations reflect the more common combinations of coverage for Medicare beneficiaries that do not have any other retiree health insurance coverage such as employer-sponsored group health insurance program (including Federal Employee Retirement Health Benefits (FEHB)), VA, CHAMPVA or TRICARE coverage

2. Based on research by the Kaiser Family Foundation which found that the 48% of all Medicare beneficiaries are enrolled in a Medicare Advantage plan relative to 25% of all Medicare beneficiaries on traditional Fee-For-Service Medicare with a Medicare Supplement (based on data from AHIP Center for Policy and Research)

3. Medicare requires beneficiaries to have ‘creditable’ Part D prescription drug coverage in order to avoid late enrollment penalties. A standalone Part D prescription drug plan is required to avoid penalties if you do not have any other ‘creditable’ coverage such drug coverage from a current or former employer or union, VA, CHAMPVA or TRICARE coverage, or individual health insurance coverage

4. Assumes you purchase one of the most popular types of Medicare Supplement plans (Plan F, G or N) which represent 83% of all Medicare Supplement enrollments based on data from the AHIP Center for Policy and Research. If you live in Massachusetts, Minnesota or Wisconsin, Medicare Supplement policies are standardized in a different way to other states

5. Independent research conducted by the Better Medicare Alliance identified that beneficiaries on Original Medicare report higher out of-pocket spending than those on Medicare Advantage (almost $1,598 higher on average)

6. Ranges based on Medicare Supplement price indexes managed by the American Association for Medicare Supplement Insurance on Medicare Supplement pricing across the country

7. In many cases, you’ll need to only use doctors and other providers who are in the plan’s network (for non-emergency care). Some plans offer non-emergency coverage out of network, but typically at a higher cost.

8. All Medicare Advantage plans have a Maximum Out of Pocket Limit (MOOP). You continue to pay copays and coinsurances during a calendar year until you hit the MOOP. In 2023, the MOOP limit for all Medicare Advantage plans for in-networks services.

9. Based on research by the Kaiser Family Foundation which found that 66% of Medicare Advantage plans have no premium

10. Based on research by the Kaiser Family Foundation which found that 89% of Medicare Advantage plans include Part D prescription drug coverage and 97% or more individual plans offer some vision, fitness, telehealth, hearing or dental benefits

Want to learn more about Medicare?

Learn about Medicare with CoverRight®. Access free video content, live webinars and join our growing online community.

Excellent

Average rating 4.9 stars

Good experience, saved me money

As quick as allowable and made a complex topic easier....

Bradley Dykes

Pleasant experience

The process was made so easy by the CoverRight representative....

Leslie Boff

I usually do not speak with anyone

I usually do not speak with anyone regarding medicare but...

Dena Kimberlin

Achieve peace of mind with CoverRight

From research and evaluation to enrollment, CoverRight is your personal Medicare concierge service.

195 Broadway

4th Floor

Brooklyn, New York 11211

General Customer Support:

+1 (888) 969-7667 | TTY: 711

Hours:

Mon-Fri 8AM-10PM (ET)

Sat-Sun 9AM-7PM (ET)

CoverRight.com is owned and operated by CoverRight Inc. Insurance agency services are provided by CoverRight Insurance Services Inc.

CoverRight Insurance Services Inc. represents Medicare Advantage HMO, PPO and PFFS organizations that have a Medicare contract. Enrollment depends on the plan’s contract renewal with Medicare.

We do not offer every plan available in your area. Currently we represent 38 organizations across the nation and 3,917 plans across the nation. Please contact Medicare.gov, 1-800-MEDICARE, or your local State Health Insurance Program (SHIP) to get information on all of your options.

Not all plans offer all of these benefits. Benefits may vary by carrier and location. Limitations and exclusions may apply.

Enrollment in a plan may be limited to certain times of the year unless you qualify for a Special Enrollment Period or you are in your Medicare Initial Enrollment Period.

© Copyright 2026. CoverRight Inc. All rights reserved.